This website is a work in progress, please visit https://avoidsolicitors.com.au for other information (and evidence) of questionable conduct by KHQ Lawyers/Ms Ines Kallweit.

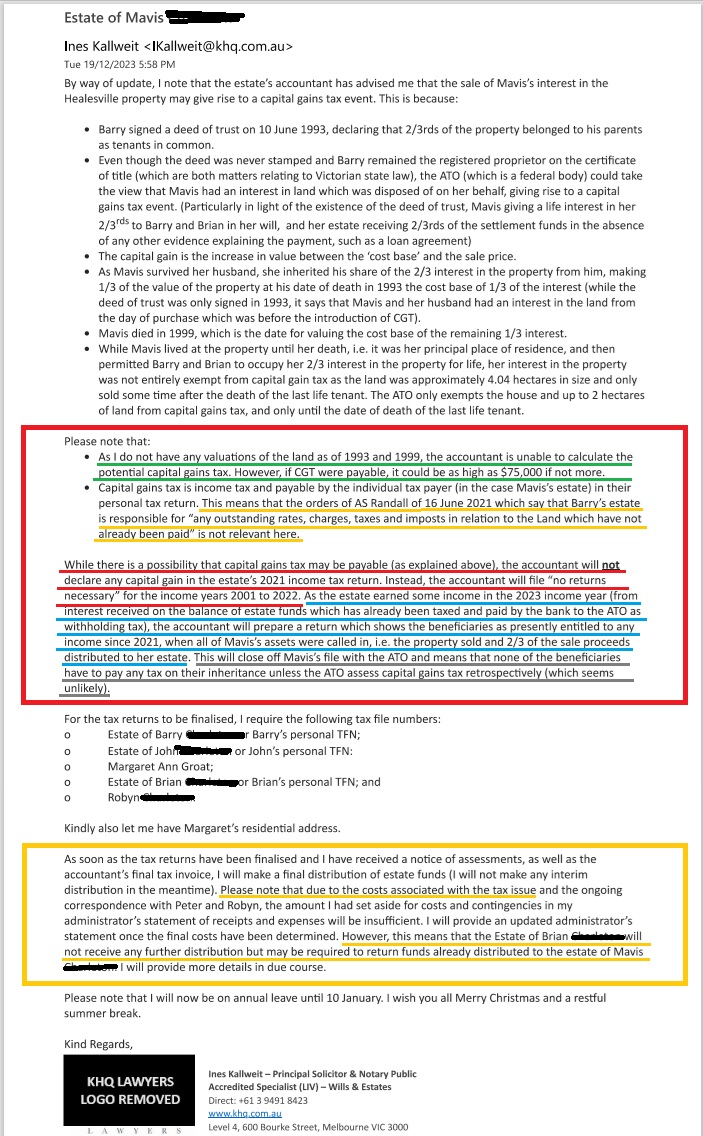

EMAIL FROM INES KALLWEIT

Sent/Received 19 December 2023

Each error/questionable sentence has been highlighted using differing colours.

GREEN: Kallweit states there were no valuations recorded in 1993 nor 1999 and "CLAIMS" Capital Gains Tax (CGT) cannot be calculated.

Using Kallweit's logic, failing to get a property valuation can assist in not having to pay CGT.... Lol, how ridiculous!

RED: Kallweit states that the accountant will NOT declare any Capital Gain in the Estates 2021 tax return...

Kallweit and the accountant are fully aware that the property sold at public auction on February 2021 for $1.2Mil... Nothing to see here, Lol.

BLUE: Kallweit talks about the interest earned on Estate funds which Kallweit placed into an interest-bearing trust account. Kallweit goes on to say how the accountant will prepare (tax) returns on behalf of beneficiaries, showing (alleging) the beneficiaries are entitled to the interest/earnings.

Filing a tax return for the Estate would be far easier than chasing up 5 x beneficiaries for their personal Tax File Numbers and submitting returns for all of them...

Kallweit's 'Plan' (as per GREEN and RED) seemingly requires the steps in BLUE in order to potentially sail through the ATO without alarms bells going off.

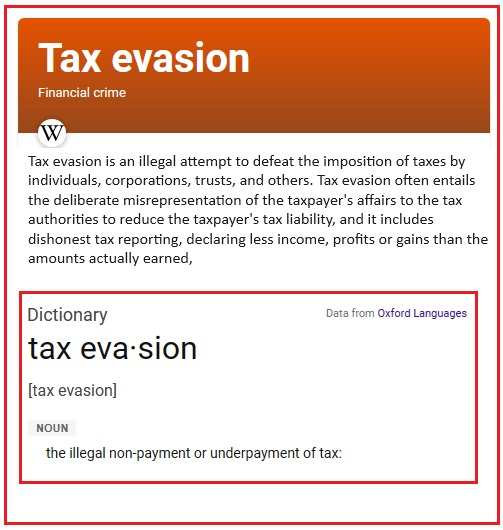

The GREEN and RED in combination with the BLUE sounds like a Plan to deliberately misrepresent Estate affairs in order to EVADE TAX!

TOTAL KHQ LAWYER INVOICES/FEES/CHARGES/ETC $41,549.79

The email of 8 May 2024 also enlightened me to the figures associated with the bank interest received/earned, those figures are as follows:

30.12.2022 Interest $396.83

31.01.2023 Interest $691.15

28.02.2023 Interest $630.90

31.03.2023 Interest $718.87

28.04.2023 Interest $696.54

31.05.2023 Interest $730.65

30.06.2023 Interest $701.43

31.07.2023 Interest $744.22

31.08.2023 Interest $226.40

29.09.2023 Interest $217.96

31.10.2023 Interest $221.10

31.11.2023 Interest $216.61

29.12.2023 Interest $228.11

31.01.2024 Interest $221.85

09.02.2024 Interest $55.74

INTEREST TOTAL $6,698.36

The email of 8 May 2024 also enlightened me to the amount of withholding tax applicable to the interest earned, the withholding tax figures are as follows:

30.12.2022 Withholding tax $186.00

31.01.2023 Withholding tax $324.00

28.02.2023 Withholding tax $296.00

31.03.2023 Withholding tax $337.00

28.04.2023 Withholding tax $327.00

31.05.2023 Withholding tax $343.00

30.06.2023 Withholding tax $329.00

31.07.2023 Withholding tax $349.00

31.08.2023 Withholding tax $106.00

29.09.2023 Withholding tax $101.00

31.10.2023 Withholding tax $103.00

31.11.2023 Withholding tax $101.00

29.12.2023 Withholding tax $107.00

31.01.2024 Withholding tax $103.00

09.02.2024 Withholding tax $25.00

WITHHOLDING TAX TOTAL $3,137.00

(ACCOUNTANT AND ADVISOR COSTS)

According to the statement of receipts and expenses which we received today (08/05/2024) from Ines Kallweit of KHQ Laywers, SW Accountants & Advisors costs for applying for tax file number for Estate, preparation and lodgment of 2023 and 2024 returns plus review of information regarding sale of property and tax implications, has cost estate:

$7,150.00